The TikTok beauty and personal care track has been booming since last year, with waves of beauty, skincare, and personal care businesses entering the market. Amidst the fierce competition, there are face scrubs with monthly sales of $3 million, peppermint mouthwash with 328,800 monthly orders, and styling sprays with over 35 million views in a single month on TikTok...

Don't get too excited; these chosen ones may have won temporary victories in the fiercely competitive beauty and personal care market. Facing worthy opponents is key. What you can do is saturate various channels with short videos, store broadcasts, reach broadcasts, and product cards, striving for more product exposure.

With white-label cosmetics flooding the market and capital pouring in aggressively, the cross-border circle has long been bustling with life and death. How to "fight the flood"? Shoplus, based on recent sales data of beauty and personal care categories in the TikTok US market, explores the business strategies of the beauty track in this TikTok beauty product report.

01 Though Leading, Lacks Firepower

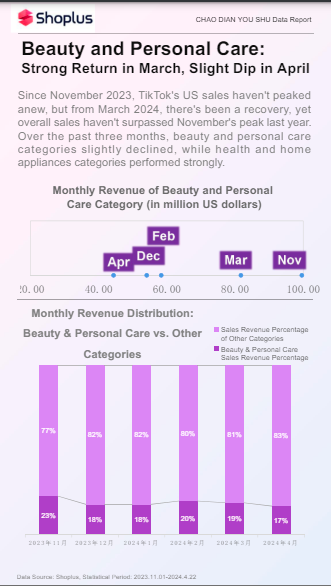

According to Shoplus' sales data analysis of beauty and personal care categories, since the opening of the US market in September last year, November quickly saw strong growth, with beauty and personal care categories taking a distinct lead over other categories. However, the outbreak period was short-lived. Since December, sales have declined by 30-40%, only returning to November levels in March 2024. As of April, the performance has been mediocre. Can the last week turn the tide? You can check real-time data on the Shoplus official website. In terms of sales proportion, the GMV proportion of beauty and personal care categories remains between 17% and 25%, with minimal fluctuation. However, in the past two months, the proportion in the entire TikTok US market has been consistently below 20%. In addition to beauty and personal care, sales proportions of hot-selling categories such as women's clothing and lingerie, sports and outdoors, and mobile electronics have all declined, while categories such as health and home appliances have increased in proportion.

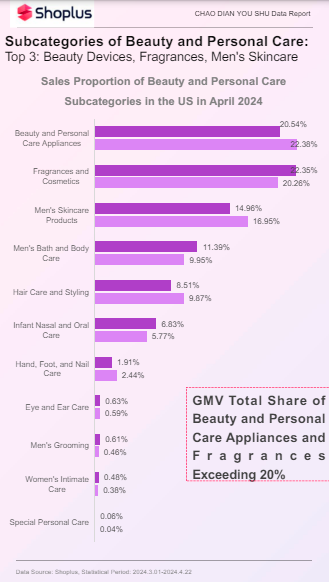

02 Beauty Appliances, Perfumes, Men's Skincare Are Booming

The beauty and personal care category is vast, with numerous subcategories. According to Shoplus platform data, sales of beauty appliances and perfumes each exceed 20%. Popular items include electric toothbrushes, shoulder and neck massagers, and curling irons. Men's skincare and bath products closely follow, comprising 10% to 15% of sales. Male grooming is a potential area for exploration.

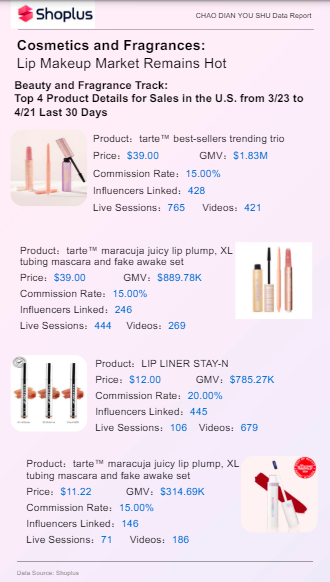

In terms of specific product rankings, here are examples from TikTok Shop's US site:

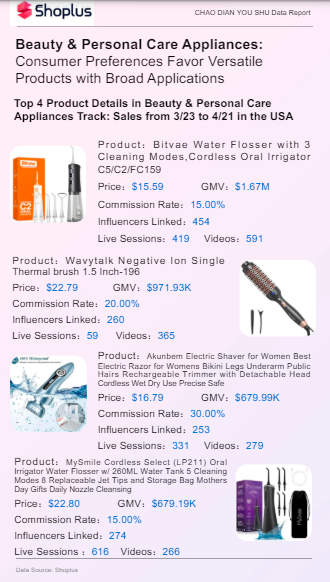

Beauty Appliances TOP 4:

TOP1: Bitvae Oral Care sold 84,200 electric toothbrushes in the latest month, generating $2.58 million in sales. After joining TikTok Shop, the brand's total sales exceeded 249,700 items, with a GMV exceeding $3.6 million.

TOP2: Wavytalk's curling iron ranked second, selling $1.08 million in March, with a single unit price of $31.98.

TOP3: Mighty Life's men's shaver sold 18,300 units in March, with a total GMV of $224,900.

TOP4: MySmile's electric toothbrush, a popular product with 1,400 associated videos and 782 influencers, dominates natural traffic.

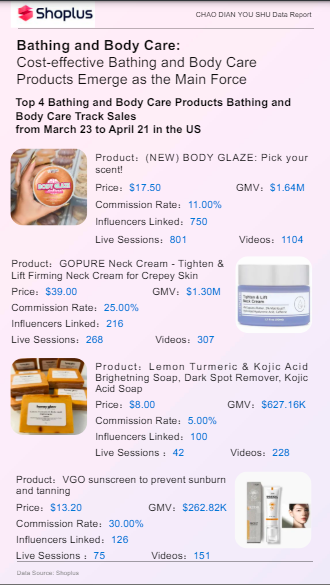

Details of the top 4 products in beauty, skincare, bath, and body care are also provided for reference.

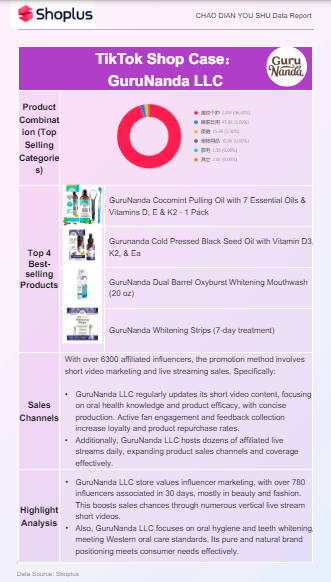

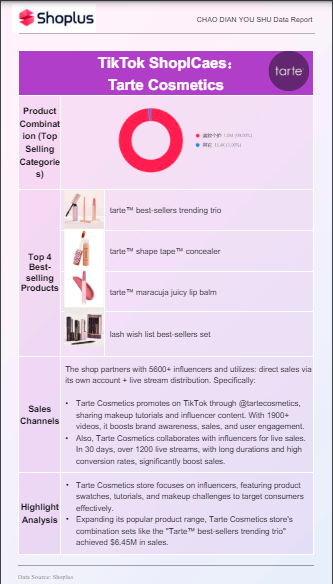

03 TikTok Shop Case

Which shop sells the best? What is the best-selling item in the shop? What marketing actions does the small store cover? Which influencer did they choose?

In the TikTok e-commerce circle, whether it's businesses or brands, high-level GMV is often inseparable from multi-matrix marketing, especially evident in the beauty and personal care sector. Based on sales ranking, Shoplus has compiled a list of the most noteworthy small stores in the U.S. beauty and personal care category. Let's take a quick look!

04 Conclusion

The TikTok beauty and personal care track has been booming since last year, with waves of beauty, skincare, and personal care businesses entering the market. Amidst the fierce competition, there are face scrubs with monthly sales of $3 million, peppermint mouthwash with 328,800 monthly orders, and styling sprays with over 35 million views in a single month on TikTok. However, these successes may only be temporary in the highly competitive market. Facing formidable opponents is crucial. To thrive, saturate various channels with short videos, store broadcasts, reach broadcasts, and product cards to enhance product exposure. With white-label cosmetics saturating the market and capital pouring in aggressively, the cross-border circle has been bustling with life and death. To combat this flood, Shoplus as a TikTok analytics tracker, leveraging recent sales data of beauty and personal care categories in the TikTok US market, explores effective business strategies in the beauty track.